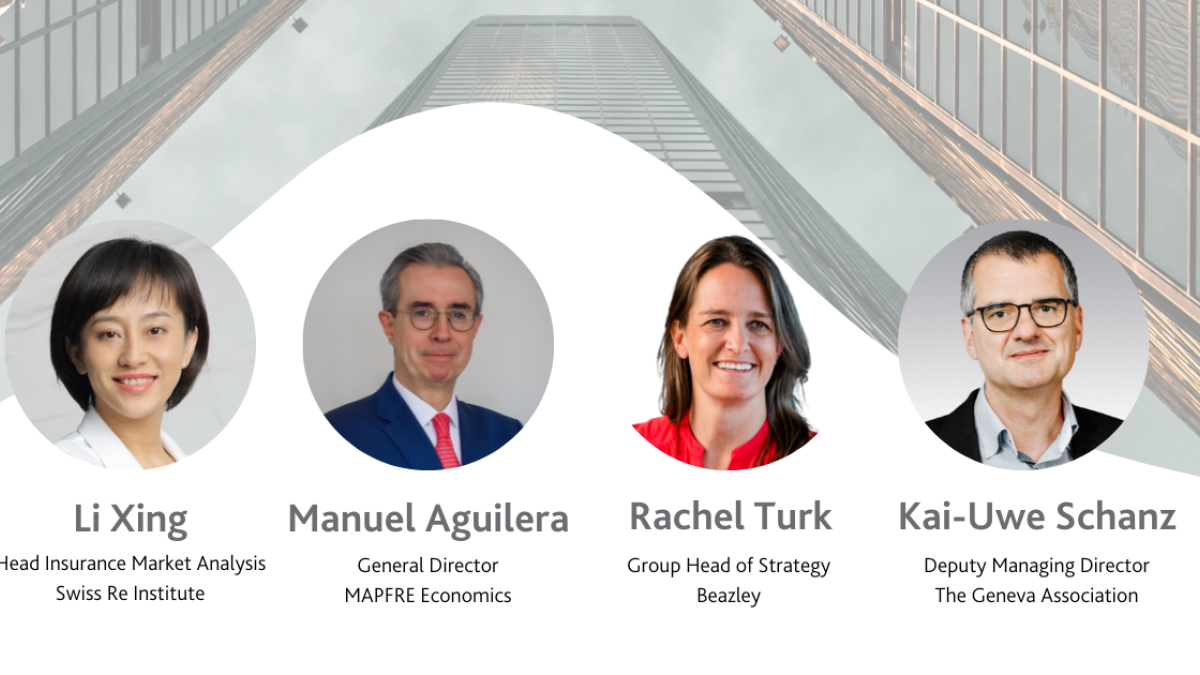

9 February 2023, 14:00–15:00 CET

Join us for a webinar on our report The Return of Inflation: What it means for insurance, examining the outlook for inflation and interest rates, what’s at stake for insurers and their customers, and strategies for adapting to a changed macroeconomic environment.

The recent resurgence of inflation came as a surprise, if not a shock, and it remains uncertain when central banks will succeed in taming the most severe bout we have seen in four decades. Inflation presents major challenges for insurers and their core business of making contingent payments at some point in the future. At the same time, the normalisation of interest rates offers opportunities in asset management and product design, especially for life insurers. Inflationary episodes typically entail lower economic growth – or even recessions – and erode purchasing power, which hurt demand for insurance. However, it can also be argued that for customers and society at large, the value of insurance increases in times of inflation and that, going forward, demand for insurance could therefore benefit from the shock of resurging inflation.

This webinar explored the current inflation outlook, its implications for insurers, their responses across the entire value chain and the short- and medium-term impact on insurance demand.