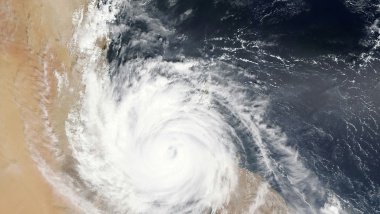

As extreme weather risks escalate and related insured losses grow in magnitude, the availability and affordability of home insurance is coming under increasing pressure in certain regions. This is being amplified by various socioeconomic factors, including poor land use, outdated building codes, and ageing infrastructure.

Focusing on the housing sectors in Australia, Canada, the EU, Japan, the UK, and the US, this report presents a two-tier approach to safeguarding home insurance: scaling up local resilience measures and implementing structural reforms to align financial systems with real risk. Property & casualty insurers are essential to managing climate-related financial risks, but they cannot act alone. Broader collaboration is needed across society to tackle underlying vulnerabilities and shift decision-making toward long-term resilience. This report offers a clear path forward, highlighting how coordinated action can keep insurance both available and affordable in a changing climate.